Most people spend decades saving for retirement, but far less time thinking about where they are saving. In many cases, money ends up heavily concentrated in traditional, pre tax accounts simply because that is what was available at work.In this video, I walk through how I actually think about the mix of traditional, Roth, and Learn More

Educational Videos

Information and resources designed to help you plan, prepare and thrive in retirement.

Check Latest Videos

Roth conversions are one of the most talked about strategies in retirement planning, and for good reason. A well timed conversion can reduce future required minimum distributions, lower your lifetime tax bill, help you avoid Medicare IRMAA surcharges, and even make things easier for a surviving spouse or for your kids.However, a poorly timed conversion Learn More

The moment the paycheck stops, everything changes. Even with years of planning behind you, the first twelve months of retirement can feel very different from what you expected. The structure of work disappears. The routine shifts. And for many people, the questions start to creep in: Am I on track? Am I spending too much? Learn More

If you are planning to retire in the next five years, the decisions you make now can have a major impact on how smooth your transition feels. In this video, I walk through the key steps that help people retire with more clarity and confidence.I start with defining what you want life to look like Learn More

Even if you have saved diligently, have no debt, and know you are financially ready, it is common to still feel uneasy about stepping away from work. After years of helping people retire, I have seen how that anxious feeling rarely comes from the numbers. It comes from uncertainty.In this video, I talk about why Learn More

If you’re planning to retire in your 50s or early 60s, the decisions you make with your 401(k) in those first few years can either save you tens of thousands of dollars or quietly cost you the same amount.In this video, I walk through five of the most common 401(k) mistakes I see people make Learn More

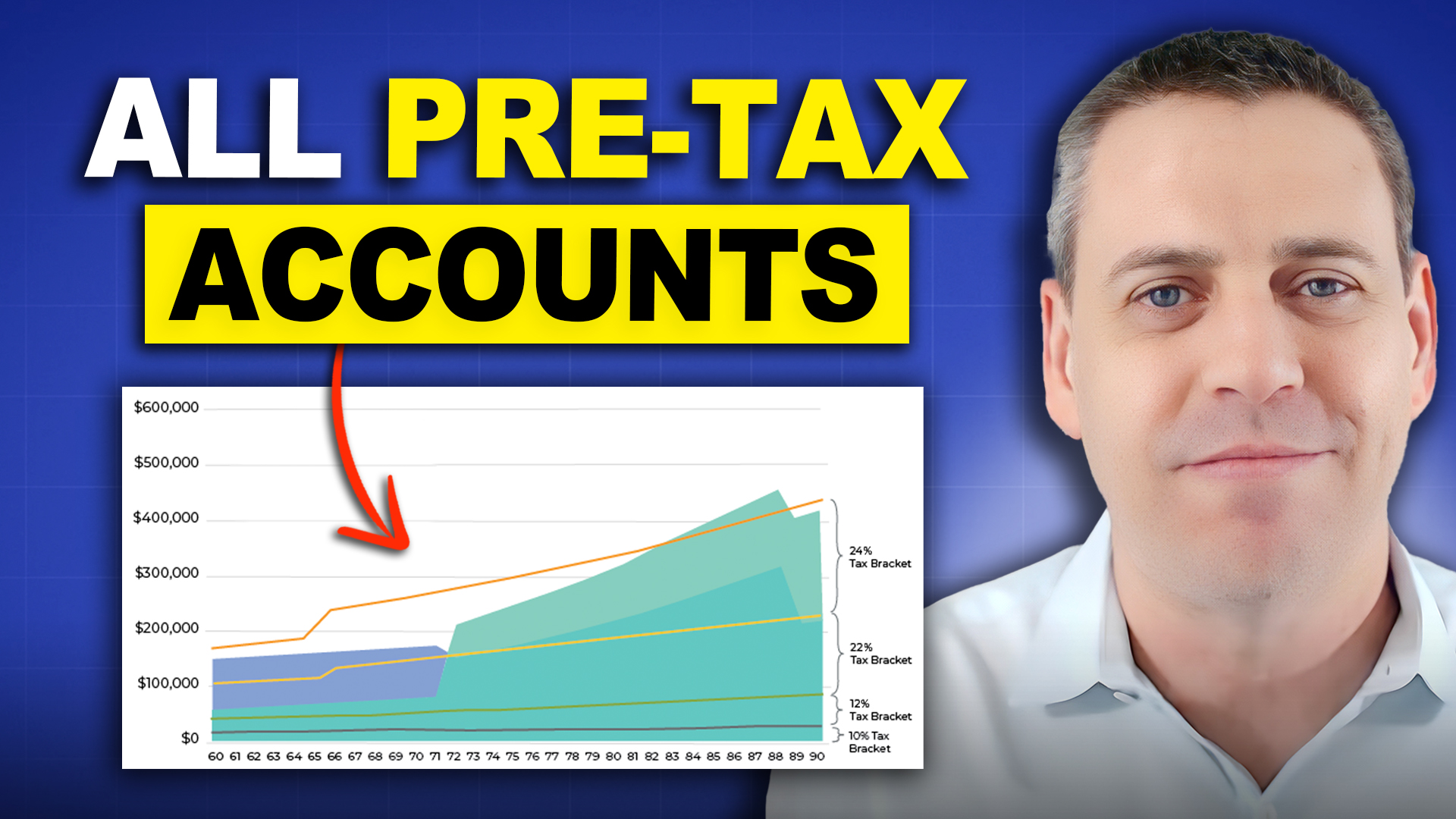

If most or even all of your savings are in pre tax accounts like 401(k)s or traditional IRAs, you are not alone. For many people, that is exactly how they were told to save. Defer taxes, let the money grow, and figure it out later. But later is now retirement, and that is where things Learn More

There is a point in retirement planning where everything changes, and it is not when you hit your first $100,000 or even $1 million. Once your accounts reach about $1.5 million, the conversation shifts entirely.At this level, retirement stops being about survival and becomes about coordination, balancing taxes, withdrawals, investments, Social Security, and Medicare so Learn More

You don’t often hear this from a financial planner, but sometimes the right move isn’t to save more, it’s to live more.In this video, I share a real life case of a couple who had already won the savings game. They were on track to have nearly two million dollars by retirement and wanted to Learn More

If you’re about a year away from retirement, one of the biggest questions on your mind is probably, “Do I have enough saved?”In this video, I walk through an example of someone retiring at 65 who wants to spend $8,000 per month in retirement. You’ll see how Social Security fits in, what kind of portfolio Learn More

Page [tcb_pagination_current_page] of [tcb_pagination_total_pages]