Deciding when to collect Social Security benefits is more complex if you have other assets or sources of income available to you in retirement. If you have money saved in retirement accounts or have other savings and investments, then even though you retire it doesn’t necessarily mean that you should start your Social Security benefits Learn More

Educational Videos

Information and resources designed to help you plan, prepare and thrive in retirement.

Check Latest Videos

A Roth IRA conversion and a contribution are not the same thing. Making a Roth IRA contribution and doing a Roth conversion are both ways to get money into a Roth IRA. However, the rules for each are very different. Often times I have found there is confusion in this area. This short video explains what Learn More

In this video I explain what Multi-Year Guarantee Annuities (MYGA’s) are, how they work, and why they have become more popular recently. We will look at the liquidity options, terms, taxes, some current MYGA rates and more. I’ll cover the important things to know about MYGA’s, and I’ll share some thoughts on how you might consider Learn More

Is your financial advisor truly planning for your future, or just coasting? In this video, Ryan and Erin lay out the five signs that your advisor is delivering genuine financial planning, not just quick fixes. A truly committed advisor will: Help you define your goals and objectives Gather details on ALIE (Assets, Liabilities, Income, and Expenses) Learn More

Couples should carefully consider the financial and emotional consequences of retiring simultaneously before making the decision. If you’re considering retiring at the same time, we walk through 4 questions you should consider first: Have You Correctly Calculated Your Cost of Living in Retirement? According to a recent study: 46% of older adults spend MORE money Learn More

You spend decades building your nest egg. Then, when you retire, you need a plan to stop saving and start spending, but not too much that you risk running out of money. It’s a delicate balance. In this video, we’ll discuss 5 variables that are important to consider:Plan for LongevityMake the Right Decision about Social Security BenefitsChoose the Learn More

When should you begin collection your Social Security retirement benefits? You can take it at anytime between age 62 and 70. What’s the right choice for you? In this video we’ll discuss some of the important things to think about when making this decision. Some of the factors you’ll want to consider include: If you Learn More

A financially secure and happy retirement doesn’t just happen; it takes planning and some modifications as you get older. In this video, I will discuss some of the mistakes. 1. Not Having a Plan 2. Forgetting about Inflation 3. Not Creating any Tax-Free Income 4. Investing too Conservatively 5. Taking on too much Risk as You Learn More

Should you buy an annuity as a part of your retirement portfolio. In this video we will examine the pros and cons of purchasing a fixed indexed annuity with a guaranteed lifetime income rider with a portion of your retirement savings. We look at a sample case study of a couple who are ages 67 Learn More

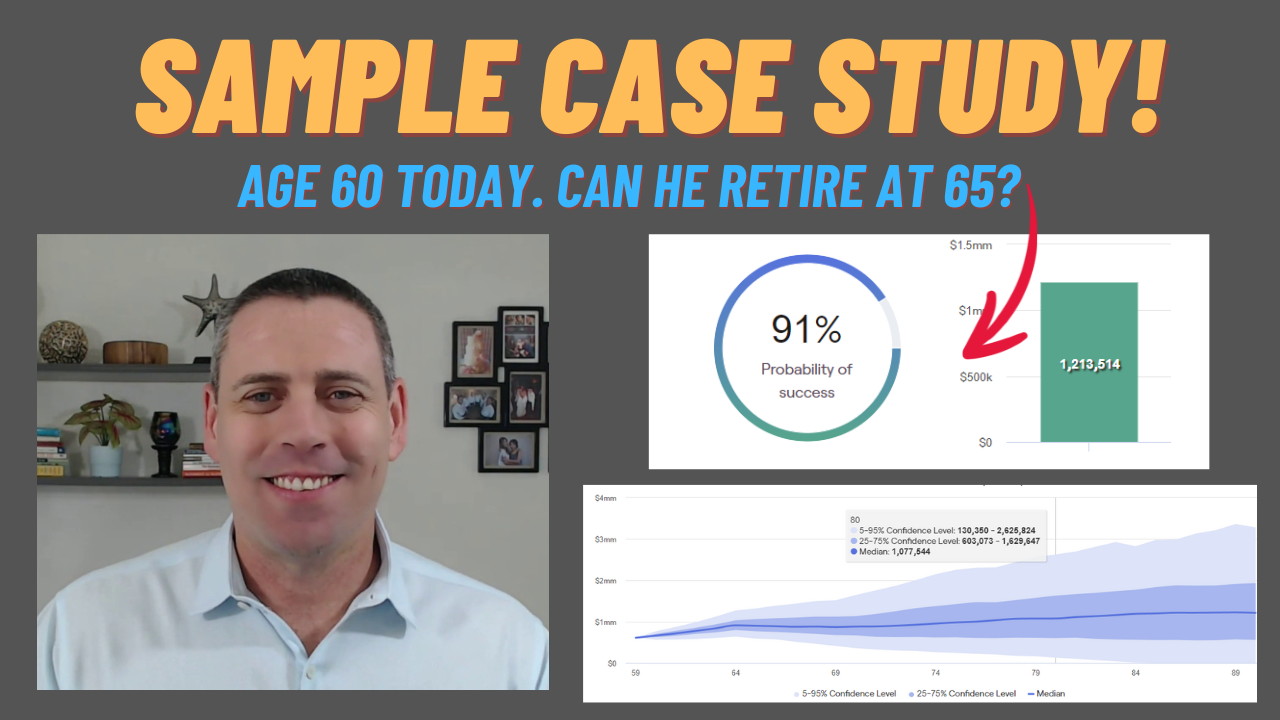

Mike was turning 60 next month. He had $400,000 in a pre-tax 401(k) and $200,000 in a taxable brokerage account. He wanted to retire at 65 if possible. In this sample case study we will discuss several things including: When he should take his Social Security (and his Survivor benefit). The pros and cons of Learn More

Page [tcb_pagination_current_page] of [tcb_pagination_total_pages]